May 05, 2022

- Gartner client? Log in for personalized search results.

Is Your Enterprise Value Model Undermining Your Ambitions?

Contributor: Jackie Wiles

In today’s complex environment, enterprise value is becoming as much about what and how you deliver value to stakeholders as it is about the value you capture in return.

Hundreds of organizations, including Gartner, have pulled out of Russia since it invaded Ukraine. Others have not. Nestlé, initially criticized for not doing so, publicly explained that its decision was driven by humanitarian concerns, not profits. Shell says its exit from Russia will cost it up to $5 billion. The calculus of these actions — or lack thereof — reflects the growing need for organizations to consider more than financials in their decision making. But traditional enterprise value models don’t effectively frame such choices.

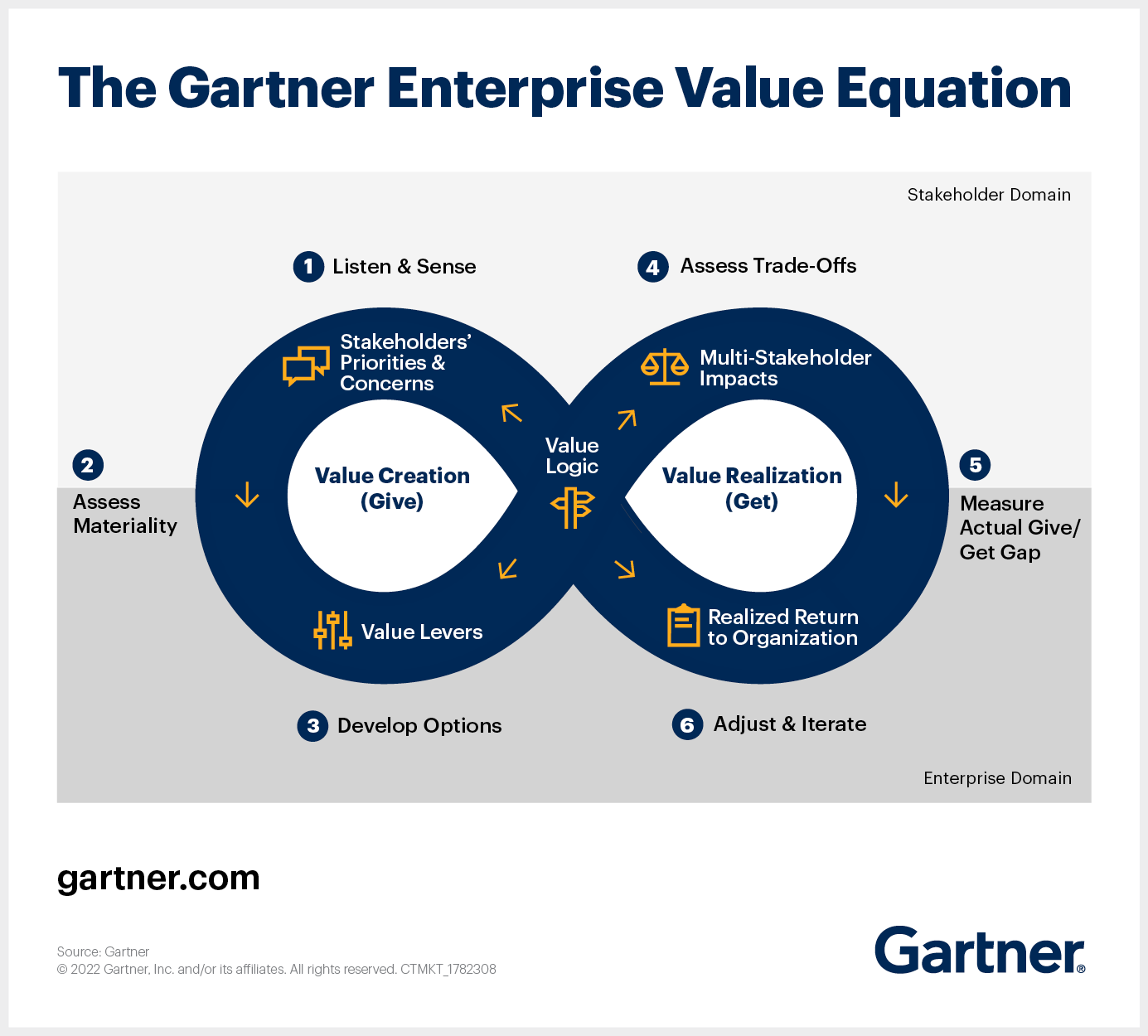

Gartner has developed a new enterprise value equation that offers executives a fresh way to view the decisions they make in terms of the impact those decisions deliver to various stakeholders and the value the organization realizes in return.

Download now: 3 Strategic Actions for Success for Your Function

We asked Rita Sallam, Distinguished VP Analyst, why a new model is needed and what it can deliver for you.

What does the Gartner enterprise value equation consider, and why?

You can’t overstate how many megatrends organizations face, among them sustainability, cybersecurity threats, digitalization, automation, the Great Resignation, inflation, shareholder activism, polarization of views and constituencies, social equality and diversity, equity and inclusion (DEI). These trends are fundamentally shifting strategy and operating models, and they create new expectations from a range of stakeholders. In this complex environment, traditional enterprise value models don’t help us make decisions that drive sustained value.

The decisions you make — which strategic initiatives to prioritize, where to invest, which value levers to pull, what you say and do — all have the potential to boost or diminish the value of your brand and business when considered across all megatrend variables, and many of them can’t be expressed purely in financial terms.

Gartner has developed a new enterprise value equation that better reflects this constant “giving and getting” of value that enterprises must balance across stakeholders and actions today.

Without a systematic way to account for this give-get reality, organizations are destined to lurch from one crisis to the next, trying to appease one set of stakeholder demands at a time without making strategically coordinated and optimized decisions about where to dedicate resources to realize value.

Despite attempts to broaden the scope of “enterprise value,” financial performance has long remained the proxy. Why is that no longer enough?

Socioeconomic theories such as stakeholder capitalism and triple bottom line emerged more than a decade ago, but, in practice, most companies still rally around optimizing shareholder value. The difference now is that organizations have to deliver outcomes in new ways to a broader range of stakeholders, many of whom have more power than ever before, in part because they have additional tools to amplify their concerns.

For example, addressing new threats like cybersecurity and opportunities like sustainability extends business outcomes beyond regulatory compliance to a range of stakeholders. Benefits or impacts at stake include safety, innovation, privacy, ecosystem and alignment with values. Impact can accrue to the organization’s brand value, reputation and loyalty, outpacing associated costs in return.

Especially since the humanitarian and economic crises of the pandemic, increasingly vocal customers and employees expect suppliers and employers to commit to brand values consistent with social justice and civic and environmental responsibility. You can’t always see the direct impact of these actions on the near-term bottom line, but they are nonfinancial leading-but-often-ignored indicators of future financial benefits. By evaluating these demands and, if warranted, addressing them, the enterprise can increase its brand value and widen its customer base.

Exiting Russia is a stark illustration of the constantly changing calculus and shows how decision makers today need a better method to weigh the pros and cons of their actions against the net impact on long-term enterprise value.

Consider the dilemma for organizations responding to activist investors, whose demands they can meet but with additional expenses and changes to operating models. Purely financial metrics would focus on the increased cost, but decision makers need a way to consider whether those costs are outweighed by the longer-term value realized in addressing material stakeholder priorities.

These types of decisions play out every day, but we lack good frameworks to account for nonfinancial variables in our cost-benefit analyses.

Are all organizations creating more nonfinancial value today?

We know the how of creating enterprise value has already changed considerably in the digital age. Just look at the shifting rankings of the highest-valued companies in the world. In 1995, General Motors, Exxon Mobil, Ford and GE topped the list; today, Apple, Microsoft, Alphabet and Amazon do.

Today’s most valuable enterprises prioritize investments not just in digital, but also in a wide range of nonphysical assets — brand, innovation, intellectual property, know-how, data, technology, software, leadership and culture.

What hasn’t changed is how we account for that value, and that’s a huge miss. We may not be able to quantify many of these benefits directly in financial terms, but they are leading indicators of financial success — and we should be allocating resources and investments to drive that.

Every decision — and the ways organizations prioritize one investment over another — must be assessed through a multidimensional stakeholder lens that takes into account both short-term financial implications and long-term impact on value in terms of brand, ability to attract talent, government support, safety and well-being, etc. If we just focus on what we can express in purely financial terms, we will most certainly misprioritize our investment options.

Using a more multifactored value equation gives IT and other business leaders a more accurate and encompassing way to respond to new stakeholder demands and demonstrate the impact on enterprise value of their decisions and investments.

Wait, what is “multifactor” enterprise value, and what are the key success factors?

Multifactor enterprise value takes continuous account of a range of material variables and value levers, enabling you to balance the value you deliver to stakeholders with the value you realize in return. This approach provides the visibility decision makers need to create opportunity, sense and respond to the critical demands of stakeholders and iterate against multiple factors as conditions change.

To employ a multifactor approach to enterprise value, you first have to listen to stakeholders so you can identify — despite the breadth, urgency, pace and volume of issues and concerns — what is material to them and you. You also need to monitor for fast-moving, high-impact disruptions.

This may require new listening mechanisms, as many organizations lack transparency on those critical elements of nonfinancial performance that are indirect but leading indicators of long-term value. You also need to measure where efforts to create value will not actually realize the intended value.

For example, doing what’s needed to get you a high score on Glassdoor doesn’t necessarily mean you’ll suddenly lose fewer people or find it easier to hire. Employees and job hunters may not perceive value in your actions in the way you expect, so you’ll need to get feedback and adjust where there is a give-get disequilibrium to reach the balance point.

Consider, too, how some oil and gas companies have gone from battling against the transition to clean energy to signaling that they embrace it. Multifactor enterprise value models can help navigate such shifts in a way that builds sustained shareholder value instead of eroding it — despite potentially negative outcomes for shareholders in the short term.

Another example: There are benefits of technology-driven innovation or investments in critical infrastructure like cybersecurity that are obvious but not easily articulated in financial terms. Yet most organizations still make strategic and resource allocation decisions using pre-digital and even pre-internet approaches that leverage a narrow set of levers to optimize value for a singular stakeholder: investors. This doesn’t tell the full value story, and it results in suboptimal resource allocation decisions.

That’s why so many CIOs, CISOs and CDOs still struggle to justify the expense of technology to their boards and CEOs, who continue to question the value of technology spend. They often fail to link technology outcomes to business outcomes and shortsightedly don’t account for the nonfinancial benefits as leading indicators of long-term enterprise value. Their give-get is not in equilibrium.

Does this multifactor approach mean balancing trade-offs for decision makers to create value for all parties at the same time?

Absolutely. And that’s far more complicated than pursuing a single measure of success like earnings per share. It requires considering the needs and demands of multiple stakeholders in deciding how to allocate resources and prioritizing one investment over another. But only by evaluating all the benefits, costs, risks, interrelationships and trade-offs can you optimize for multiple stakeholders’ outcomes — and build long-term enterprise value.

You have to make trade-offs and deconflict contradictory demands to optimize for all stakeholders and, in return, enterprise value. Again, the give-get equilibrium balances the value you deliver to stakeholders with the value you realize in return across multiple variables.

What are the risks of failing to reimagine enterprise value?

Like it or not, we are in an era of increasing stakeholder demands and pressures, growing societal disruptions and fractures, a shifting and volatile climate and rolling humanitarian crises. This requires balanced decision making and a broader construct for how to create and assess value.

We need a new way to think about value, a new enterprise value equation that is not solely about optimizing shareholder value but is the aggregate of economic, social, organizational and personal value created from delivering on the organization’s products, services or mission.

A more continuous value creation process enables enterprise decision makers to listen, assess, act, measure, adjust and evolve. Failing to do so risks lasting damage to your organization — not just in terms of short-term financial results, but also in the form of dissatisfied customers, disengaged employees and misguided investment choices.

Headlines are full of examples of missteps by organizations that put financial considerations over the interests of other stakeholders, from Purdue Pharma ignoring shifting social sentiment on opioids, to Wells Fargo associates creating fake accounts to meet sales goals, to Uber failing to check sexual harassment, to Facebook allowing disinformation to flourish on its platform, to Equifax exposing customers to data breaches.

A singular legacy view of enterprise value doesn’t just create risks; it also results in underinvestment in those value outcomes that can’t be easily expressed in financial terms but create long-term value for the enterprise. Living in this suboptimal zone just because you can’t measure the alternative, means you’ll leave a host of opportunities on the table

In short:

- Today’s business environment is full of conflicting variables, discontinuity and disruption. Critical nonfinancial factors increasingly play a role in value creation, but traditional return-on-investment models can’t properly account for their contribution.

- What’s needed is a more powerful multifactor and multi-stakeholder approach — a new enterprise value equation — in which organizations balance decision making within a broader construct of how to exchange value with all stakeholders.

- A new continuous value creation process enables enterprises to listen, assess, act, measure, adjust and evolve their decisions to create sustainable long-term value and impact.

Experience Gartner Conferences

Join your peers for the unveiling of the latest insights at Gartner conferences.

Recommended resources for Gartner clients*:

A Practical Approach to Strategic Thinking on Enterprise Value for CIOs

*Note that some documents may not be available to all Gartner clients.